County Budget Summary

This form is part of the December submittal due December 31st of each year

The Instructions for completing the Budget Summary sheet for the Anticipated County Road Fund Revenue and Expenditures are listed in the steps below.

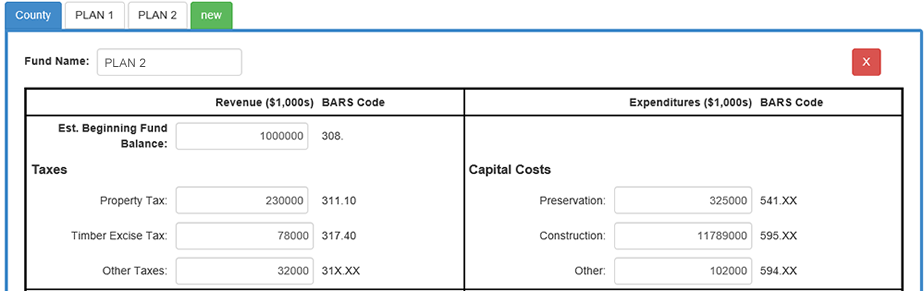

- For those counties that have separate operating or capital funds (Ferry, Construction, etc) that provide direct "road purpose" services, complete this form separately for each of the funds.

- Enter values in actual dollar amounts.

- Using your officially adopted Road Fund Budget, fill in the appropriate fields for the Revenue and Expenditure sections in the worksheet.

-

Click the Save button to save your fund.

To add a new fund

- Click the new tab.

- Enter the name of the fund in the Fund Name field.

- Click the Save button at bottom of the worksheet.

To delete a fund

- Click on the tab for the fund that you want to delete.

- Click the delete button.

General Notes

Other general notes:

- The "beginning fund balance" is to be the total amount projected to be in the fund the start of the fiscal year (this is understood to be an estimate).

- New sub-section for "Capital Costs" is designed to reinforce BARS 541 is intended for use by GAAP (Generally Accepted Accounting Principles) entities using the modified approach for asset reporting.

- "Property Tax" revenue and "Traffic Policing" expenditures should not include any diverted Road Levy (RCW 36.33.220) amounts.

It is no longer necessary to send us your adopted budget document.

Note: CRAB is considering requiring a new end-of-May form for counties to report actual revenues and expenditures. If implemented, the form would be nearly identical to this budget summary form in level of detail. This step would likely take place together with a significant simplification of the required end-of-May financial report to WSDOT.